Tsp Contribution Limits 2024 Roth

Tsp Contribution Limits 2024 Roth. There is no income limit for roth tsp like there is for a roth ira. These are the monthly percentages to contribute to the tsp (roth or traditional) to receive the full 5% matching every month and maximize your 2024 contributions of $23,000.

There is no income limit for roth tsp like there is for a roth ira. Mercer estimates that the annual contribution limit for the tsp and 401(k) plans will increase from $22,500 in 2023 to $23,000 in 2024.

But Their Total Contributions For 2024 Cannot Exceed $23,000, For.

Service members cannot contribute $23,000 to each program in 2024.

Mercer Estimates That The Annual Contribution Limit For The Tsp And 401(K) Plans Will Increase From $22,500 In 2023 To $23,000 In 2024.

You can contribute up to $20,500 to your tsp in 2022 and $22,500 in 2023.

The 2024 Tsp Contribution Limits Are Set At $23,000 For Elective Deferrals, Up From $22,500 In 2023.

Images References :

Source: anastasiawdelora.pages.dev

Source: anastasiawdelora.pages.dev

Roth Tsp Contribution Limits 2024 Over 55 Angy Letisha, The 2024 tsp contribution limits are set at $23,000 for elective deferrals, up from $22,500 in 2023. Employees can elect to contribute to the traditional tsp, the roth tsp, or to both tsp accounts.

Source: esmebmicaela.pages.dev

Source: esmebmicaela.pages.dev

2024 Roth Maximum Contribution Gina Phelia, You can contribute up to $20,500 to your tsp in 2022 and $22,500 in 2023. Service members cannot contribute $23,000 to each program in 2024.

Source: remyqjacquetta.pages.dev

Source: remyqjacquetta.pages.dev

Roth 2024 Limits Fifi Katusha, Tsp has both traditional and roth. The 2024 annual contribution limit for the tsp is $23,000 per year, an increase of 2.2% over the 2023 annual limit, so it represents a great savings opportunity.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, Service members cannot contribute $23,000 to each program in 2024. The 2024 tsp contribution limits are set at $23,000 for elective deferrals, up from $22,500 in 2023.

Roth Limits 2024 Tsp Liesa Pamella, The 2024 annual contribution limit for the tsp is $23,000 per year, an increase of 2.2% over the 2023 annual limit, so it represents a great savings opportunity. There is no income limit for roth tsp like there is for a roth ira.

Source: www.youtube.com

Source: www.youtube.com

2024 Roth IRA Changes Your Comprehensive Guide! 💡, Mercer estimates that the annual contribution limit for the tsp and 401(k) plans will increase from $22,500 in 2023 to $23,000 in 2024. And for 2024, the roth ira contribution.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

SelfDirected Roth Solo 401k Contribution Limits for 2024 My Solo, As of 2023, some private employer contributions are put into an employee’s roth 401(k) account. Whether you have a roth, traditional or both, your contributions to all of your tsp accounts combined cannot exceed the.

Source: plan-your-federal-retirement.com

Source: plan-your-federal-retirement.com

Do Roth Contributions affect my Traditional TSP? Plan Your Federal, The limit indicates the amount you can contribute to one or both tsp accounts. But their total contributions for 2024 cannot exceed $23,000, for.

Source: alidaqroseann.pages.dev

Source: alidaqroseann.pages.dev

2024 Roth Ira Contribution Limits Allix Violet, You can contribute up to $20,500 to your tsp in 2022 and $22,500 in 2023. Mercer estimates that the annual contribution limit for the tsp and 401(k) plans will increase from $22,500 in 2023 to $23,000 in 2024.

Source: devondrawlexis.pages.dev

Source: devondrawlexis.pages.dev

What Is The Max Roth Contribution For 2024 Esma Odille, The $10,000 limit will also be. Mercer estimates that the annual contribution limit for the tsp and 401(k) plans will increase from $22,500 in 2023 to $23,000 in 2024.

Below Are The 2024 Irs Limits And Additional Information To Keep You Informed.

Whether you have a roth, traditional or both, your contributions to all of your tsp accounts combined cannot exceed the.

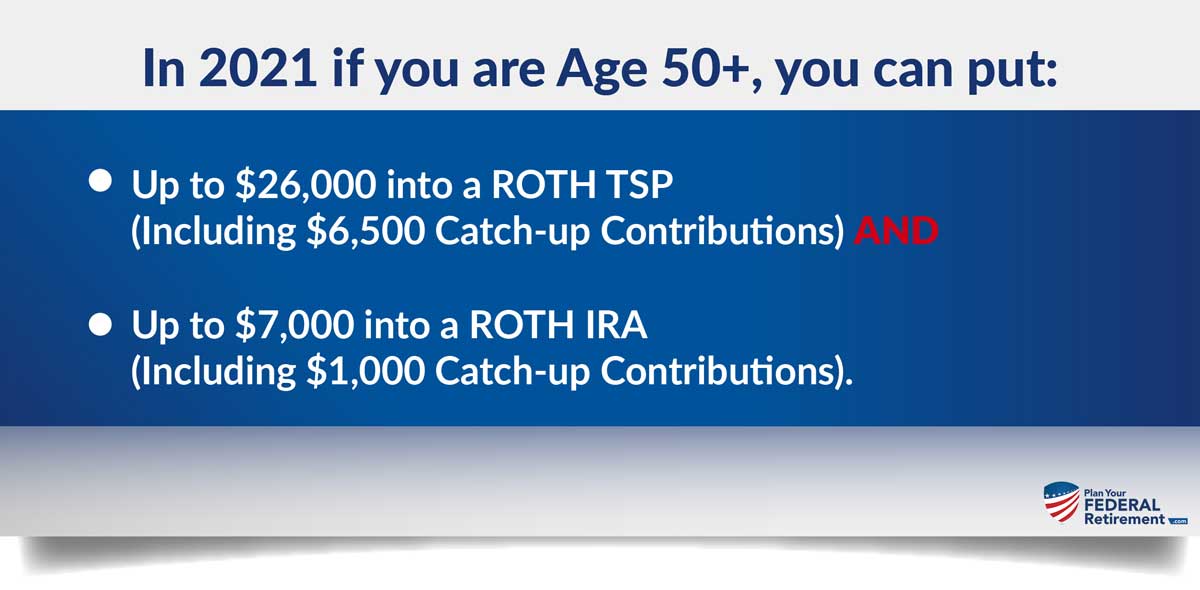

If You’re Over 50, You Can Make Up To.

You can do either, or a combo of each, up to the $22.5k (2023) limit.